QuickBooks The Best Accounting Software for Small Businesses & Freelancers in 2025

Set your business up for success with QuickBooks, the trusted accounting software for small businesses, freelancers, and entrepreneurs. Invoicing, expense tracking-you name it, QuickBooks makes managing your finances easy, accurate, and efficient.

Start now and enjoy real-time financial insights, automated bookkeeping, and tax-ready reports that give you more time to focus on what truly matters.

QuickBooks Introduction:

QuickBooks is a leading accounting software designed for small business owners, freelancers, and accountants who can meet all their financial needs with ease. With a huge client base of millions across the globe, QuickBooks has made accounting jobs easy and user-friendly, right from expense tracking, invoicing, payroll, and even presenting a detailed financial report.

From a budding enterprise to an already established one, QuickBooks has various tools to make accounting pretty simple. Its cloud-based platform is designed to make sure business owners have access to real-time data anywhere, thus making confident decisions on the go. QuickBooks also integrates with hundreds of third-party applications, offering great versatility and the opportunity to be customized to suit the needs of enterprises from any size bracket.

QuickBooks is not just a bookkeeping tool but also an all-in-one financial assistant that automates most of the accounting tasks and reduces the chances of errors. With scalable pricing plans and a wide array of features, QuickBooks helps businesses save time, improve financial accuracy, and stay compliant with tax regulations. Whether you are handling taxes, creating budgets, or managing cash flow, QuickBooks has the tools you need to keep your business financially healthy.

Key Features of QuickBooks: Comprehensive Tools for Business Management and Financial Tracking

1. Easy Invoicing & Billing

QuickBooks has made invoicing pretty easy. With QuickBooks, you can design professional-looking invoices with your company’s logo in no time, customize invoices with payment terms, and track the real-time status of the receipt of payments. It also lets you send invoices via email directly from the platform. Once an invoice is sent, QuickBooks automatically tracks the payment status to ensure you know if a payment has been made or an invoice has gone past due. You can even set up automatic payment reminders to make sure customers pay on time.

Customize: Make branded invoices with your logo and terms.

Payment Tracking: Get notified when a customer pays or when an invoice is overdue.

Automation: Create recurring invoices for subscriptions or repeat customers.

2. Expense Tracking

QuickBooks integrates seamlessly with your bank and credit card accounts to automatically import and categorize your business expenses, meaning all your spending is tracked without your ever having to key anything in. For example, if you buy office supplies, QuickBooks will categorize the expense and track it for you. Attach receipts to transactions and view reports that show you exactly where your money’s going by category, which makes it so much easier to monitor cash flow and keep costs under control.

Bank Feeds: Bank account and credit card transactions are automatically imported.

Receipt Capture: Snap pictures of receipts and attach them to their respective transactions.

Categorization: Categorize all the various expenses for keeping things neat and organized at tax time.

3. Payroll Management

QuickBooks takes the headache out of payroll with its automated payroll feature. This allows you to calculate wages, taxes, and deductions automatically. It accommodates different pay schedules, such as weekly, bi-weekly, and monthly, handles direct deposits, and files payroll taxes for you. QuickBooks also calculates year-end forms like W-2s and 1099s to keep you in compliance with the tax laws.

Automated Payroll: Automatically calculate paychecks, deductions, and taxes.

Direct Deposit: Pay employees quickly and easily via direct deposit. Tax Filing: QuickBooks files payroll taxes for you and generates tax forms.

4. Tax Calculation and Filing

QuickBooks makes it easier to file your taxes because it automatically calculates the sales tax, VAT, or other taxes that will be applicable on the particular transaction. QuickBooks creates ready-to-use reports and auto-populates all the required boxes in the appropriate tax forms according to your data in QuickBooks, without any tedious re-typing. QuickBooks also keeps your business compliant by automatically updating the latest tax rates and compliance rules.

Automatic Tax Calculations: Automatically calculate the tax on sales or purchases.

Tax Reports: Get reports summarizing the amount of taxes owed and paid.

Pre-filled Forms: Prepares tax forms for you, reducing the chances of errors.

5. Financial Reporting & Insights

QuickBooks has over 100 in-depth reports you can customize, such as the Balance Sheet, Profit and Loss Statement, and Cash Flow Statement. This suite of reports depicts your business’s financial condition and assists in tracking sales, expenses, and profitability. You could filter these reports further on specific periods, customers, or even expense categories for real depth in your visibility into your finances.

Customize reports to your business. Reports can be presented for the current, as well as ongoing, financials and trends. More business-related decisions can be made through actionable reports.

6. Bank Reconciliation

QuickBooks makes bank reconciliations a breeze through the system’s capability for the automatic matching of your business’s transactions with those recorded in the bank account. This process keeps your financial records updated and correct. It also detects discrepancies easily for you, which makes missing or incorrectly posted transactions easier to locate before they can turn into problems later on.

Automatic Matching: It automatically matches your bank transactions to your QuickBooks records.

Discrepancy Detection Made Easy: Identify discrepancies and correct errors in just a few clicks.

Reconciliation Reports: Get detailed reports showcasing your reconciliation status.

7. Multi-User Access

With QuickBooks, you can invite your accountant, business partners, or employees to access your account. You can control what data each user can access, ensuring that sensitive information stays secure. Role-based permissions let you assign different levels of access based on user responsibilities, thus enabling secure collaboration and real-time updates.

Role-Based Permissions: Customize user access based on roles.

Collaborative: Multiple users can work in QuickBooks simultaneously.

Security: Control sensitive data and prevent unauthorized access.

8. Inventory Management

QuickBooks offers an advanced inventory system that will enable you to track your products, monitor your level of stock, and then create a purchase order when your minimum level is reached. This advanced system updates your stock levels when you sell or buy an item to let you know your quantity on hand. Besides, the system calculates COGS to give you an insight into profitability.

Real-time Inventory Update: Updates inventory automatically for each sale or purchase. Low Inventory Alerts: Set up notifications when the inventory level is low. Purchase Order: Create and track purchase orders with ease for the restocking of inventory.

9. Customizable Dashboard

QuickBooks has a customizable dashboard where you can arrange the information that is most important to you. You can view key metrics like sales, expenses, and bank balances from one screen for easy tracking. In this way, you can make rapid judgments about the well-being of your business and take action. You will be able to add or remove widgets to your liking.

Personalized Layout: Positioned widgets that display the most relevant data to your business.

Key Metrics: Instant overview of Sales, Expenses, and Profits

Custom widgets: Tailor the dashboard for your business.

10. Cloud-Based Access

QuickBooks is cloud-based; hence, all your financial information is saved online in a secured manner. Whether you are in the office, at home, or on the move, your QuickBooks account is accessible on every platform so you can access reports, create invoices, and track expenses. This means that you will be able to access your financial data from anywhere in the world.

Accessible Anywhere, Anytime: Access your data anywhere on any device with an internet connection.

Automation of backups: automatic backup of the data reduces the possibility of misplacing it.

Update in real time: access updated business data no matter wherever you go.

11. Mobile Application

QuickBooks has a mobile application for iOS and Android. It lets you handle your finances from any place. You can create and send invoices, track expenses, capture receipts, and run reports right from your phone or tablet. This flexibility is particularly helpful for entrepreneurs and small business owners who are always on the move.

Full Functionality: You can carry out important tasks related to your business, such as invoicing and expense tracking, on your mobile.

Expense Capture: Take photos of receipts and attach them to your expense records.

Mobile Reports: Run and review financial reports right from the application.

12. Time Tracking & Billing

With QuickBooks, businesses involved in hourly service provision can easily track the time of their employees or contractors. You will be able to log hours worked, attribute them to certain projects or clients, and automatically generate invoices based on tracked time. Thus, you correctly bill for all of your services.

Track Time by Project: Log time against particular clients or projects for accurate billing. Generate Invoices: Invoicing becomes easier, based on tracked hours. Time Reports: Look at reports of summarized time against projects or by employees.

13. Integration with Third-Party Apps

QuickBooks integrates with over 650 third-party apps, so you can have your data sync across your business tools. Whether it be an eCommerce platform like Shopify, a payment processor like PayPal, or a time-tracking app like TSheets, QuickBooks seamlessly connects with those tools to negate manual data entry for you.

App Marketplace: Discover hundreds of integrated apps to manage your business seamlessly.

Sync Data: Easily sync sales, payments, and expenses across different platforms.

Custom Integrations: Integrate QuickBooks with your specific business tools for enhanced functionality.

14. Estimate & Quote Generation

For businesses that deal with client estimates or quotes, QuickBooks lets you create professional proposals and estimates. Once approved, these quotes can easily be converted into invoices, streamlining the entire process from estimation to payment.

Create Estimates: Generate quotes that can be sent to clients directly.

Convert to Invoices: Turn approved estimates into invoices automatically.

Track Estimates: keep a tab on the status of all your estimates and follow up in the right manner accordingly.

15. Project Tracking

QuickBooks has project tracking tools that will enable you to track the profitability of certain projects. You can track time and expenses incurred and revenue earned for each project individually. This helps you ensure projects are completed within budget and on time.

Track Project Costs: Keep a close tab on all expenses incurred for a particular project.

Profitability Insights: Understand in real time which projects are the most profitable. Manage Multiple Projects: Keep track of several projects simultaneously, each with its own set of metrics

Top Benefits of Using QuickBooks for Efficient Business Financial Management

QuickBooks is designed to offer all-inclusive tools that will help a business manage its finances, ranging from simple bookkeeping to advanced financial analysis. The tool targets a wide range of business types, from freelancers and small businesses to larger enterprises, making it quite versatile for managing financial data. Specific benefits that QuickBooks provides are outlined below.

1. Efficient Financial Management

QuickBooks makes financial chores easier and quicker to handle. It keeps all your financial data in one place so you can stay organized, and some key aspects are:

Expense Tracking: QuickBooks instantly tracks business expenses and sorts them out into their respective categorizations automatically. For example, if you make a purchase or pay a bill, QuickBooks enters it into your books and charges that particular account in which the expense belongs, such as utilities, marketing, office supplies, etc. This takes away manual data entry and saves you from losing any single expense.

Income Tracking: QuickBooks enables you to track your inflow-the money that is coming into the business. It links to your bank account or credit card and imports the transactions automatically. It lets you make invoices and send them, followed by keeping a track when it is paid and, further, maintains your accounts receivables.

Cash Flow Management: QuickBooks makes it less difficult for monitoring cash flow, being one of the most critical activities in running a business. You are able to see an updated picture of inflow versus outflow, making prediction and management easier. It helps you project into the future with ease by underlining what bills and other expenses will fall due soon.

2. Real-Time Reporting and Insights

QuickBooks generates these reports in detail for enlightened ideas regarding the health status of a business. The reports track performance, show where the money has gone, and enhance decision-making. Here are some essential ones:

P&L Statement: This report enables you to track revenues, expenses, and profit over a certain period. From this statement, you are able to analyze or come to a conclusion whether your business is running on profit or loss.

Balance Sheet: The balance sheet is a snapshot of the financial position of your business at any one point in time, representing your assets, liabilities, and equity. This report is important for a proper understanding of your overall financial standing.

Cash Flow Report: This is the report that provides insight into inflow and outflow regarding your business in terms of money. It is reflected by showing liquidity, which makes an approximation about paying off a liability.

Customizable Reports: QuickBooks allows for the creation of custom reports from particular parameters that capture financial data relevant to your business. You can tailor these reports to match your unique business needs.

3. Ease of Use

QuickBooks has an intuitive and friendly interface that even non-accountants find easy to use. The design ensures that the business owner gets everything he or she needs with minimal hassle. The following are some of the features that make it user-friendly:

Customizable Invoices: With QuickBooks, you can create and send professional invoices with your business’s logo and details. You can also set up recurring invoices for regular clients or customers to save time from manually generating an invoice.

Bank Reconciliation: QuickBooks automatically imports your bank and credit card transactions and matches them with the records in the software. This automatic bank reconciliation feature reduces errors and saves time by eliminating the need to enter transactions manually.

Easy Navigation: The user interface is designed to help you navigate quickly between tasks such as invoicing, expense tracking, and reporting. You can quickly access your financial data and accomplish your tasks efficiently with simple, organized menus.

4. Time-Saving Automation

QuickBooks saves you time by automating many of the routine accounting tasks so that you can focus on growing your business. Key time-saving automation features include:

Automated Invoicing: Create repeating invoices to automatically go to the customer on a schedule, be it weekly, monthly, or quarterly. This ensures you’ll never miss an invoice and frees your time from such mundane tasks.

Bill Payments: You can also set up bill payments to automatically be paid to vendors, saving yourself from any late fees and ensuring all financial obligations you have are always on time.

Bank Reconciliation Automation: With QuickBooks automatically importing bank transactions, reconciliation becomes faster and more accurate. The software matches transactions with your books, flagging any discrepancies for review.

5. Scalability for Growing Businesses

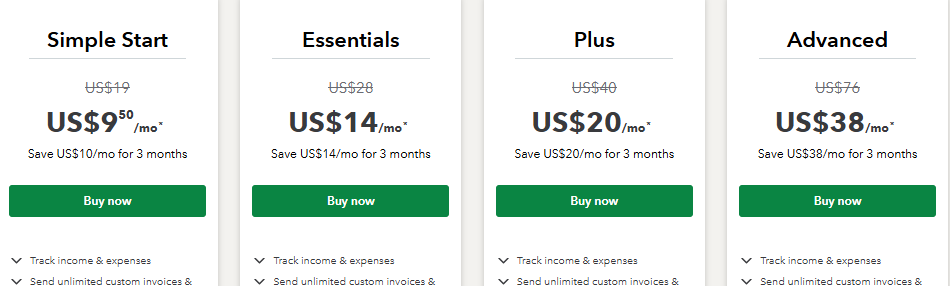

As your business grows, so does QuickBooks. The software has different plans and features that grow with you. Whether you are just starting out or managing a more complex business, QuickBooks provides the tools that support the expansion of your business.

Entry-Level Plans: QuickBooks offers simple, affordable plans for freelancers and small businesses alike, providing essential features that include invoicing, expense tracking, and basic reporting.

Advanced Features for Larger Businesses: QuickBooks offers more advanced features in inventory management, time tracking, and payroll processing for an expanding business. These will help you manage increasingly complex financial data as your operations expand.

6. Secure and Cloud-Based

QuickBooks hosts all your financial information online in a secure cloud environment. The advantage of this kind of cloud infrastructure is:

Data Security: QuickBooks protects your financial information with state-of-the-art encryption protocols so that your information is secure from unauthorized access. Automatic backups guard against data loss due to system failure.

Remote Access: Enjoy cloud-based access to reach your financial information from any device connected to the internet. Whether you are on the go, in the office, or working from home, you are always connected to the finances of your business.

Multi-User Collaboration: Cloud access also makes it easy for multiple team members or accountants to collaborate on the same data simultaneously. You can assign different levels of access to users, ensuring that only authorized individuals can view or edit sensitive information.

7. Seamless Integration

It should integrate well with third-party apps and software for smoothness in most of your business processes. Integrating this tool with other tools will allow you not to re-input any data manually on the platform, hence giving you freedom to focus on other business matters with less likelihood of errors.

E-commerce Integration: It is integrated with famous e-commerce platforms like Shopify, WooCommerce, and BigCommerce, which may connect sales into QuickBooks.

Payment Gateway Integration: QuickBooks is integrated with various payment gateways, including PayPal, Square, and Stripe, that automatically import your payments and make managing customer payments very easy.

Payroll and Time Tracking: QuickBooks is integrated with payroll services and time-tracking apps to provide a comprehensive solution to manage employee salaries, taxes, and benefits.

8. Tax Preparation Made Easy

QuickBooks makes tax preparation easier by allowing you to track tax-deductible expenses and create necessary tax reports, so that tax season isn’t as painful and you are always prepared.

Track Deductible Expenses: QuickBooks categorizes and tracks business expenses, ensuring you capture every possible tax deduction.

Generate Tax Reports: QuickBooks auto-generates tax reports such as Profit & Loss Statements and Balance Sheets, which can be provided to your accountant or tax preparer.

Estimated Tax Calculations: This tool will help in estimating how much you need to pay quarterly, according to your income, and an approximation of how much is owed by tax time.

9. Customer Support and Resources

QuickBooks has extended its support to help customers get through any problem or query that arises. Be it a technical glitch or learning how to work certain features, QuickBooks offers:

Live Customer Support: QuickBooks has 24/7 support over the phone and via live chat to help you resolve issues as soon as possible.

Help Center & Tutorials: The help center in QuickBooks is very strong, with a bunch of articles, video tutorials, and FAQs that help you solve common problems and learn about the features of the software.

Community Forum: On the QuickBooks Community Forum, you can communicate with other users, ask questions, and share your best practice advice with others.

10. Mobile Access

QuickBooks’ mobile app gives you quick access to your financial information on the go. The following are some key features for mobiles:

On-the-Go Expense Tracking: Take the photo of receipts and categorize them as a business expense, facilitating easier working of expense reporting.

Send Invoices: You can create an invoice and send it directly from your mobile device, so you will never miss an opportunity to bill clients.

Access to reports: You will be able to see all your financial reports and insights anywhere, any time. That helps track real-time performance for your business

QuickBooks Made Our Accounting Effortless

QuickBooks Online is a powerful cloud-based accounting solution perfect for small to medium-sized businesses. It offers automated invoicing, expense tracking, and seamless bank integration. With multi-user access and mobile support, managing finances on the go is easy.

John Doe Tweet

QuickBooks Desktop provides robust accounting tools for businesses that need offline access and advanced reporting features. It’s great for inventory management and job costing but lacks the mobility of the online version.

John Doe Tweet

Ideal for freelancers and independent contractors, QuickBooks Self-Employed simplifies expense tracking, tax calculations, and invoicing. However, it has limited scalability, making it unsuitable for growing businesses.

John Doe Tweet

QuickBooks FAQs: Common Questions Answered About Features, Pricing, and More

What is QuickBooks?

QuickBooks is a family of accounting software developed by Intuit, aimed at assisting small and medium-sized businesses in keeping their finances in order. This includes a powerful set of tools ranging from bookkeeping to payroll processing, invoicing, expense tracking, financial reporting, and even tax preparation. QuickBooks has varying versions to fit the needs of different businesses, including QuickBooks Online, which is cloud-based, and QuickBooks Desktop, which is software-based. Many entrepreneurs and accountants use it to make the financial workflow and management of the business easier and faster.

How does QuickBooks help with bookkeeping?

Best Answer: QuickBooks simplifies the bookkeeping process through the automatic recording of your business transactions, classifying of all your expenses, and tracking of your income. It can link directly to your bank and credit card accounts, downloading transactions in real-time. You can also manually enter transactions, and QuickBooks will automatically bucket them into the right accounting buckets-for example, expenses, revenue, assets. You can also use it to reconcile your accounts and develop important financial reports, such as balance sheets and profit and loss statements, so that you stay on top of your financial position and maintain accuracy.

Can QuickBooks manage international transactions?

Yes, QuickBooks does support multiple currencies, hence making international transactions pretty easy to handle. You can create invoices and bills in different currencies, and QuickBooks will automatically apply exchange rates. The software also provides conversion reports, which help businesses manage foreign transactions more easily and accurately.

Can I track time with QuickBooks?

Yes, QuickBooks allows you to track billable hours for employees or contractors. You can create a timesheet, record hours worked, and then convert them into client invoices. This feature is most helpful for those in service-oriented businesses or as freelance professionals who need to invoice their clients for hours worked.

Does QuickBooks offer a free trial?

Yes, QuickBooks offers a 30-day free trial for QuickBooks Online. In this trial, you get to use all the features and functionalities of the software without any commitment. This will give you a chance to see if QuickBooks is suitable for your business before subscribing to a paid plan.