Streamline Your Accounting with FreshBooks – The Smartest Way to Manage Your Business Finances

FreshBooks helps you manage invoices, expenses, and time tracking effortlessly—so you can focus on growing your business.

FreshBooks Introduction

Sometimes, it might seem that the management of finance is overwhelming for business owners, freelancers, and entrepreneurs who have to do a lot during the day. That’s where FreshBooks steps in. FreshBooks is an online accounting software built for simplicity and ease in the financial management of businesses of any size. Whether it’s sending invoices, tracking expenses, or analyzing cash flow, FreshBooks provides the tools and insights you need to take control of your finances and grow your business with confidence.

FreshBooks was designed on a single premise: to make accounting painless, even for those who had never tried to keep books in their lives. With its intuitive interface, powerful features, and workflow automation, FreshBooks removes the complexity from managing financial tasks so you can spend less time on paperwork and more time doing what you love. From creating professional invoices to accepting online payments, FreshBooks helps you get paid faster while maintaining a professional image in front of your clients.

However, with FreshBooks, that does not stop at invoicing. That extends to time tracking, project management, expense tracking, and financial reporting-everything you need in one spot to run an organized business. Plus, with its mobile app, you can also manage your finances anywhere and at any time, something very suitable for busy professionals always on the move.

One of the hallmarks of FreshBooks is that it has ease of use in mind. Its interface is highly intuitive, making it easy to get around; setup only takes a few minutes. You will not have to be an accounting expert to start using it. The helpful guides, a customer support team, and abundant educational resources guarantee that even novice users can master the basics in no time.

FreshBooks also integrates with popular tools such as PayPal, Stripe, G Suite, Shopify, and more, allowing you to connect your accounting system to the apps you already use. Its customizable features and flexibility make it ideal for a wide range of industries: creative professionals, consultants, contractors, and small businesses.

Security is something taken very seriously at FreshBooks. Your data is encrypted in such a way that your business and client information will be safeguarded at all times. Multi-user access lets you share access with your team or accountant without sacrificing any control over sensitive financial information.

Whether this be to save time, minimize errors, or build a better view of your business’s financial standing, FreshBooks is the clever alternative that the modern business owner needs. Millions of people from around the world have trusted FreshBooks to make their accounting painless so that they could reach their goals. Leave spreadsheets in the dust for an accounting platform that is hardworking as you are.

FreshBooks is more than software; it’s a partner to your business success. Try FreshBooks today and see why millions of entrepreneurs trust FreshBooks to make managing your finances a breeze.

FreshBooks Key Features: Simplify Invoicing, Expense Tracking, and Accounting

1. Easy Invoicing

FreshBooks lets you create professional-looking invoices and send them off in minutes.

Personalize your invoices with your branding, logos, and colors.

Setup recurring invoices for ongoing clients.

Automatically send reminders for overdue payments.

Get paid faster by accepting payments directly on invoices with online payment integrations.

Real-time tracking of invoice status: sent, viewed, and paid.

2. Expense Tracking

Keep track of your business expenses with FreshBooks’ intuitive expense management.

Connect your bank account or credit card to import and categorize expenses automatically.

Take pictures of receipts with the mobile app and log on the fly.

Categorize expenses by client or project for accurate billing of clients.

Create expense reports that show spending and what is tax-deductible. 3. Time Tracking

Bill correctly with FreshBooks’ time-tracking tools.

Track time manually or use the built-in timer.

Organize logs by client or project.

Automate the billing process by adding billable hours directly to invoices.

Understand how your team spends their hours by analyzing time reports.

4. Payment Processing

FreshBooks helps you get paid faster by making it easy to collect payments.

Get paid by credit cards, ACH transfers, and PayPal directly in your invoices.

Integrate with Stripe for secure payment options.

Allow automatic payments on recurring invoices.

Convert foreign currency payments with multi-currency support built in.

5. Project Management

Project Management Tools: Manage your projects effectively along with your team and clients on FreshBooks.

Share files, notes, and feedback within the tool itself.

Assign tasks to team members with deadlines.

Monitor project progress and budgets in real time.

Allow integration of time tracking into projects for accurate billing.

6. Financial Reporting

Generate comprehensive reports showcasing the detailed financial insights of your business using FreshBooks.

Prepare profit and loss statements, tax summaries, and expense reports.

Keep track of revenue, expense, and cash flow trends.

Customize reports to suit your needs.

Export reports for tax filing or sharing with your accountant.

7. Mobile Application

Manage all your finances from any location using FreshBooks’ mobile app, which comes in both iOS and Android versions.

Send invoices and record expenses from anywhere.

Access financial reports and dashboards in real-time.

You can track time and log billable hours on the go.

Keep in touch with your clients and team at any time and from any place.

8. Automating Work

Save time by automating tasks with FreshBooks to minimize manual effort.

Automate Recurring Invoices and Payment Reminders

Automatically Reconcile Bank Transactions

Keep your data in sync across FreshBooks and other apps with integrations.

Set Up Automatic Late Fees for Timely Payments

9. Multi-Currency and Multi-Language Support

FreshBooks makes doing business internationally simple. It supports up to multiple currencies and languages.

Invoice clients and receive payments in over 150 currencies

Translate your invoices into your client’s language

Automated exchange rate calculation.

10. Collaboration and Multi-User Access

Smoothen your collaboration, be it with your team or external stakeholders.

Give controlled access to team members, contractors, and accountants.

Assign user roles – owner, staff member, contractor, accountant, etc.

Share financial data in real-time securely.

11. Tax Compliance and Deductions

FreshBooks keeps you tax-ready throughout the year.

Organize your expenses into categories for seamless tracking of deductions.

Create summaries and reports for taxes.

Automatically add sales tax to your invoices based on where you are.

Export your tax reports for filing or sharing with your accountant.

12. Seamless Integrations

FreshBooks integrates with the most sought-after third-party apps and services to help extend functionality further.

Among the many integrations, FreshBooks supports integrations with well-known platforms: PayPal, Stripe, G Suite, Zapier, Shopify, among others.

Sync data with your bank account, payroll services, and CRM tools.

Automate workflows across multiple tools, saving time and effort.

13. Scalability for Growing Businesses

FreshBooks grows with your business by scaling and flexing to adapt to your evolving needs.

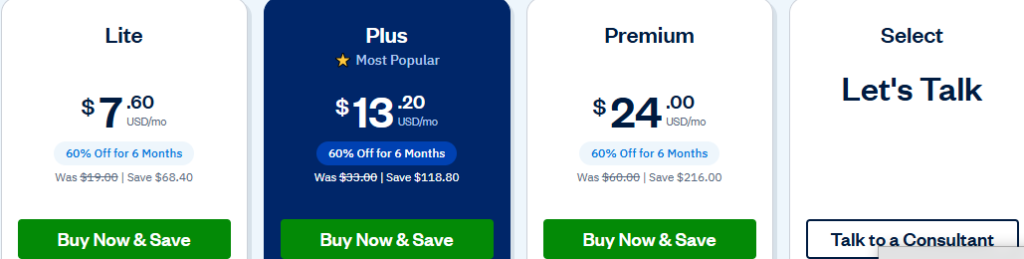

Upgrade plans to unlock advanced features like team management and reporting.

Add users and collaborators as your team grows.

Manage several businesses from one account in FreshBooks.

14. Award-Winning Customer Support

FreshBooks provides dependable and quick customer support for a seamless experience.

Access an extensive knowledge base with tutorials and guides.

Reach out to support agents via email or phone.

Enjoy personalized support tailored to your needs.

15. Security and Privacy

FreshBooks takes the security and safety of data through stringent and comprehensive security measures.

Send and receive data through 256-bit SSL encryption.

Additional protection for their account through two-factor authentication.

Be rest assured due to regular backup and adherence to industry norms.

FreshBooks Benefits: Save Time, Simplify Invoicing, and Grow Your Business

1. Save Time and Increase Productivity

The most significant of all challenges for any small business owner is effective time management. FreshBooks saves hours by automating routine tasks-from invoicing and reminders to keeping track of your expenses. On the platform, you can set up recurring invoices and automatically send payment reminders; therefore, there is no need for you to actually follow up on the clients. Integrated time-tracking tools make it easy to record billable hours and automatically add those billable hours to your invoice.

With FreshBooks, you can reduce the time spent on administrative work and focus more on the important stuff that means growing your business.

2. Get Paid Faster

FreshBooks makes it easier to invoice clients and get paid faster. It provides professional-looking invoices and multiple ways for clients to pay you, including credit cards, PayPal, and direct ACH payments, so they can pay you instantly and securely online. It further extends the facility of FreshBooks to create automatic overdues invoices, payment reminders for customers so that you are less likely to miss any payments. With its “Pay Now” button on an invoice, your clients can click and make any payments quickly; hence, positive cash flow is maintained.

3. Gain Better Financial Insights

FreshBooks lets you create reports in such a way that you can put a finer point on your financial health. Profit and loss reports, expense reports, tax summaries, and many more are easily created with just a few clicks. These reports give you the data you need to make informed decisions, manage your budget, and understand where your money is going. The user-friendly FreshBooks interface offers dashboards that can be customized for ease of access in real time to key financial metrics.

Having a detailed insight into financial matters allows you to be organized, avoid surprises, and plan for growth.

4. Stay Organized and Reduce Stress

Tracking receipts, invoices, and financial records becomes very overwhelming and a big headache, especially during tax season. FreshBooks takes the pain out of organization: It automatically categorizes and stores your receipts, invoices, and expenses in one central place. You can take photos of receipts on the go with the mobile app, and they’re added automatically to your expense records.

This level of organization reduces the chances of losing an important document and enables you to have everything at your fingertips when you want it.

5. Ease of Tax Filing

One of the most stressful things about running a small business is doing your taxes. FreshBooks takes some of that stress away by tracking all income and expenses of your business and categorizing your records for taxation purposes. Their tax reports can also summarize your expenses and deductions to help you maximize the amount you will save on taxes. Plus, with FreshBooks, you can share financial statements with your accountant or file your own tax return.

FreshBooks makes tax season less stressful and ensures you don’t miss any important deductions.

6. Improve Client Relationships

With FreshBooks, you can create personalized invoices that speak volumes about your brand’s personality and professionalism. This goes a long way in improving the perception of your business by your clients and building better relationships with them. In addition, FreshBooks has a client portal where your clients can access their own invoice history, making it easier for them to review and pay invoices at their convenience.

FreshBooks helps build trust and credibility in your business relationships by allowing clients to enjoy a professional, seamless invoicing experience.

7. Enhance Collaboration with Your Team

FreshBooks allows multi-user access, hence enabling users to invite team members, contractors, or accountants to manage projects, keep finances in order, and have access to data relevant for the job. You are able to assign roles and permissions so everyone can have the information they need without compromising sensitive data. This feature makes sharing financial reports, task management, and collaboration smoother.

The features of collaboration enable better teamwork, especially for growing businesses that need to be on the same page.

8. Flexibility for Growing Businesses

FreshBooks grows with your business: be it small, scaling to larger teams, or big. Whether your business is small and just taking off, FreshBooks will allow you to be flexible with several plan types. It also means, as your business grows, upgrading to a larger FreshBooks plan unlocks advanced features in workflow automation, reporting, and management tools. It also means being able to grow easily-the scalability of FreshBooks ensures this tool will add value as the business evolves.

9. Seamless Integration with Other Tools

FreshBooks integrates perfectly with a suite of the most popular business tools, including PayPal, Stripe, Shopify, G Suite, and many more. This provides FreshBooks with confidence in perfect integrations with tools that you use day in and day out. Keep data entry at a minimum by automating tasks using accounting data in other platforms, leaving you with extra free time to minimize errors.

FreshBooks integrates with your existing tools to ensure your business functions are in complete harmony with each other.

10. Cloud-Based Accessibility

Because it is cloud-based, your financial information will be made accessible anytime, anywhere across the globe. Be it at home, while on travel, or even with some time spare in the office; all records related to accounting would be kept securely, and accessed via any device having internet access. FreshBooks app enables you to track time and manage your business anywhere, wherever you are.

Cloud-based access ensures that your financial data is always at your fingertips from any location.

11. Award-winning customer support

With FreshBooks, you get reliable customer support for any help that might arise anytime. From problems requiring technical issues to the way some features work, the friendly knowledgeable support of FreshBooks will come forth and take control. You may contact them either via email or by calling, while a complete knowledge base has several articles and video tutorials as well.

Having access to expert support ensures that you’re never alone when using FreshBooks.

FreshBooks FAQs: Answers to Your Questions About Invoicing, Payments, and More

1. What are FreshBooks?

FreshBooks is an online accounting software designed to help small business owners, freelancers, and entrepreneurs organize their finances. It includes tools for invoicing, expense tracking, time tracking, project management, and generating financial reports, designed to streamline your accounting tasks and save you time.

2. Is FreshBooks suitable for freelancers?

Yes, FreshBooks is great for freelancers. It features custom invoices, making expense tracking easy, plus time-tracking features for billable hours, as well as tools to manage clients. FreshBooks makes managing your business finances on the go pretty easy.

3. Can I use FreshBooks to invoice clients?

Of course, with FreshBooks, you can create professional-looking invoices in just minutes and email them to your clients. You can even accept payments directly on the invoice. You can also set up recurring invoices for regular clients.

4. Does FreshBooks offer a free trial?

Yes, FreshBooks does have a 30-day free trial. Within this time, you’ll get to try out all features on the platform without being subscribed to a paid plan. It is a great way to see if FreshBooks will work for your business.

5. Can I track my expenses with FreshBooks?

Yes, you can easily track your expenses and categorize them with FreshBooks. You are able to add receipts, link your bank and credit card accounts, and auto-import your expenses into your FreshBooks account, which makes everything more organized.

6. How can I create a log of time in FreshBooks?

FreshBooks comes with an integrated timer to track billable hours in real-time, but you can also log time entries manually. All of your time entries can be attached to specific projects and clients for easier creation of accurate invoices.

7. Can I send reminders for overdue invoices?

Yes, FreshBooks will automatically send reminders when the payments are late. You are able to set the time and tone for sending those reminders, and thus you won’t have to bug them again and again.

8. Does FreshBooks offer accounting features?

Yes, some of its accounting features include generating profit and loss reports, balance sheets, tax summaries, and more. These tools give you a clear picture of your financial health.

9. Does FreshBooks allow online payments?

Yes, FreshBooks does support online payments via multiple integrations with PayPal, Stripe, and credit cards. Clients can pay you directly through your invoices using such channels, and this means getting paid faster.

10. Is FreshBooks cloud-based?

Yes, FreshBooks is cloud-based; thus, you can access your accounting data from anywhere and at any time, provided you have access to the internet. This also means that your data is securely backed up and stored.

11. Can I use FreshBooks for tax purposes?

Yes, FreshBooks helps with tax filing by categorizing your income and expenses, generating tax reports, and tracking tax-deductible items. It’s a useful tool for preparing your taxes and sharing reports with your accountant.

12. Does FreshBooks have mobile apps?

Yes, FreshBooks has mobile apps for both iOS and Android devices. With the app, you can send invoices, track time, manage expenses, and access reports from your phone or tablet.

13. How secure is my data on FreshBooks?

FreshBooks secures your data with 256-bit SSL encryption. Be sure that all your transactions and financial information are well-protected. Besides, it provides two-factor authentication.

14. Can I collaborate with my team on FreshBooks?

Yes, FreshBooks would let you add team members, contractors, and accountants to the account. Assign them specific roles and permissions so that everyone gets access to the right information while keeping sensitive data secure.

15. How do I integrate FreshBooks with other software?

FreshBooks integrates with several third-party apps, including PayPal, Stripe, Shopify, and Zapier. This will make integration with FreshBooks help you automate your workflow by automating data entry.

16. Is FreshBooks scalable as my business grows?

Yes, FreshBooks is highly scalable. As your business continues to grow, you will be able to upgrade to a higher plan that will offer advanced reporting, more clients, and team members. FreshBooks is designed to grow with your business.

17. Can I manage multiple businesses with one FreshBooks account?

Yes, FreshBooks can handle multiple businesses, all within one account. In this way, it becomes easy to maintain the financial records of a number of businesses, using only one login.

18. What payment methods does FreshBooks support?

Yes, FreshBooks supports many different forms of payment methods: credit cards, ACH transfers, and PayPal. You can customize your client’s payment option in such a way that paying becomes very easy for them.

19. How does FreshBooks compare to other accounting software?

FreshBooks is known for ease of use and attention to small businesses and freelancers. It provides less elaborate, more intuitive tools than the other accounting software. It is ideal for entrepreneurs that don’t have any need for advanced accounting functions.

20. Is it possible to cancel my subscription to FreshBooks anytime?

Yes, you can cancel your subscription to FreshBooks at any moment. FreshBooks doesn’t have a commitment policy; therefore, it’s free to cancel or downgrade your plan without penalties. You may use your account until the end of your billing cycle.

Testimonials

Testimonials

FreshBooks is a fantastic choice for small businesses and freelancers looking for easy-to-use accounting software. Its intuitive interface, automated invoicing, and time-tracking features make managing finances effortless. The cloud-based platform ensures access from anywhere, and integrations with popular tools streamline workflow. While it may lack some advanced accounting features, it's a perfect fit for those who need simple, efficient financial management.

Anthony Tweet

FreshBooks shines in invoicing and expense tracking, making it ideal for service-based businesses. You can create professional invoices, set up recurring billing, and accept online payments easily. The mobile app is a bonus for on-the-go access. However, it may not be the best choice for large enterprises needing complex financial reports.

Anthony Tweet

One of the biggest strengths of FreshBooks is its user-friendly interface and excellent customer support. Even if you're not an accountant, navigating the platform is simple. The support team is responsive and helpful, making it easy to resolve any issues. Though some features, like advanced inventory tracking, are limited, it's a great choice for entrepreneurs and freelancers.

Beginners Tweet